Overview

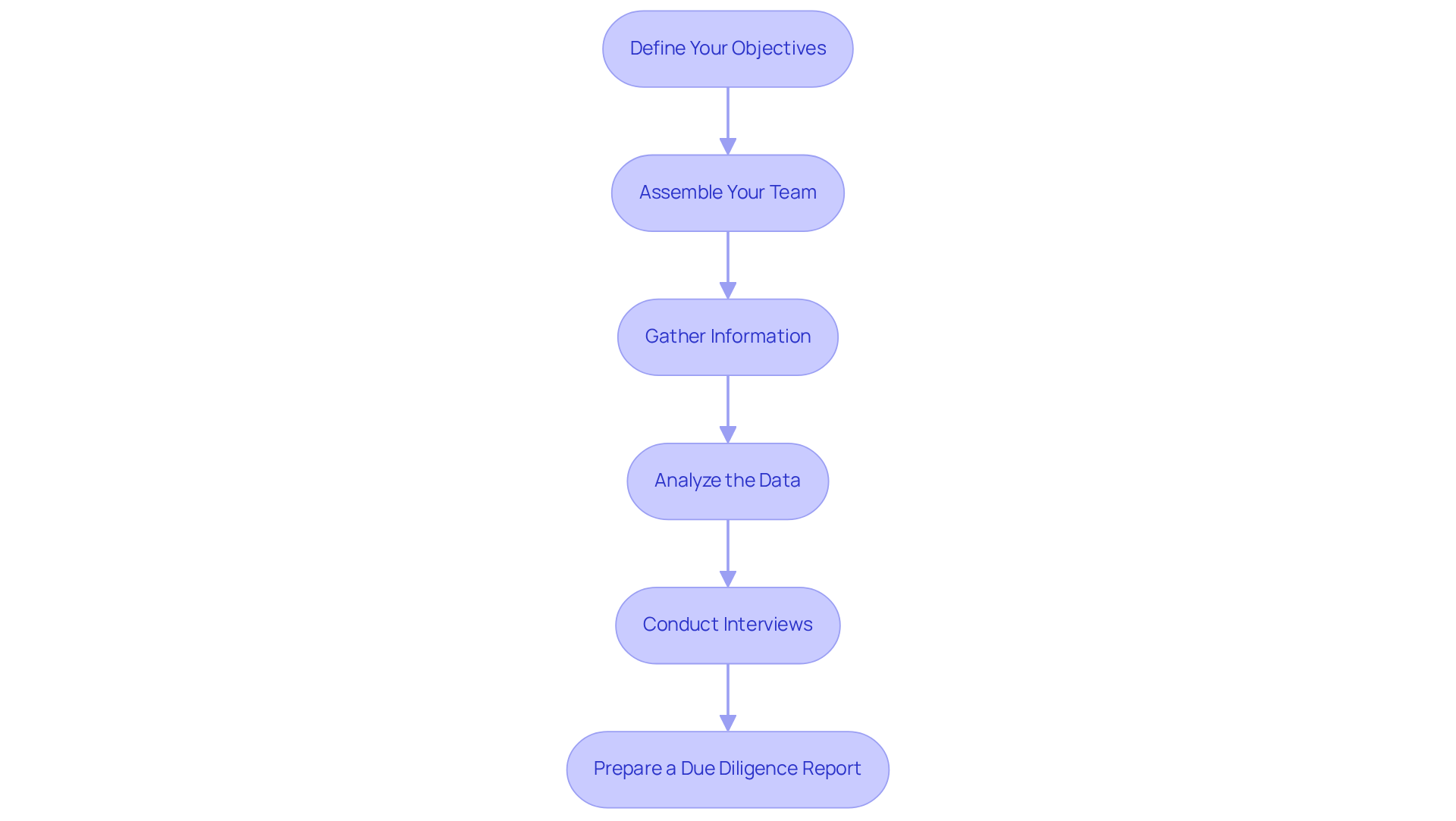

The article presents a structured approach to successful business acquisition due diligence, underscoring the critical need for thorough evaluation across financial, legal, operational, and cultural dimensions. It articulates a comprehensive four-step process designed to enhance effectiveness:

- Defining objectives

- Assembling a skilled team

- Gathering and analyzing data

- Preparing a comprehensive report

This method not only mitigates risks but also ensures strategic alignment throughout the acquisition process, demonstrating a clear pathway to success.

Introduction

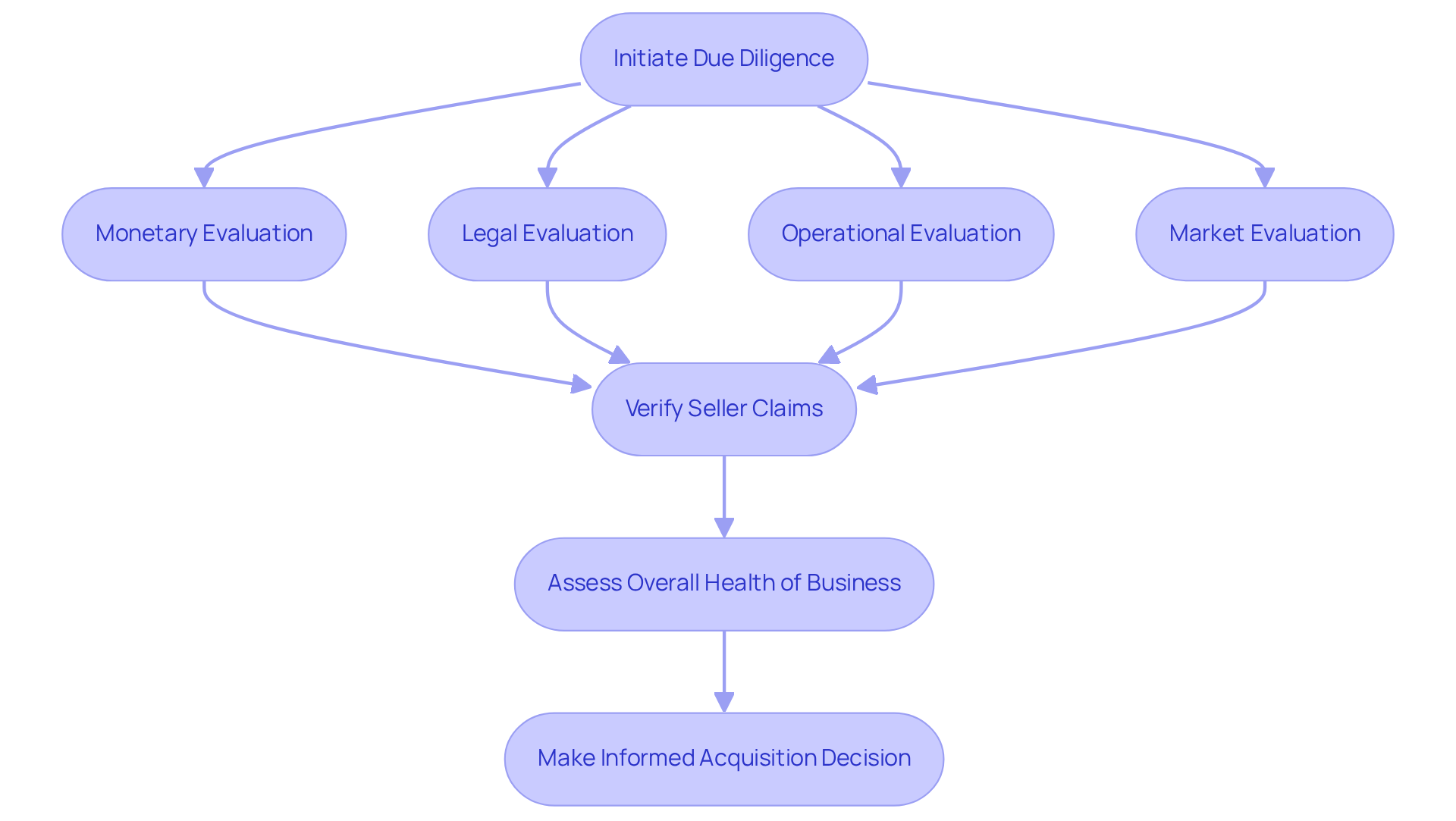

Understanding the intricacies of buying a business is essential for any investor looking to make a strategic acquisition. The due diligence process serves as a crucial safeguard, enabling buyers to verify claims, uncover hidden liabilities, and assess the overall health of a target company. However, with the evolving landscape of mergers and acquisitions, many potential buyers grapple with the complexities of this essential phase. How can they navigate this intricate process to ensure a successful acquisition while effectively mitigating risks? This guide outlines four key steps to mastering due diligence, empowering buyers to make informed decisions that align with their strategic goals.

Understand Due Diligence in Business Acquisition

Careful consideration is a critical and multifaceted process that necessitates a business due diligence involving thorough investigation of a target company. This process encompasses monetary, legal, operational, and market evaluations, all aimed at verifying the seller’s claims and assessing the overall health of the business. The primary objective is to mitigate risks and make informed decisions that align with strategic goals. Typically initiated after signing a letter of intent and preceding a formal purchase offer, a business due diligence empowers buyers to uncover hidden liabilities, validate financial statements, and ensure alignment with their acquisition strategy.

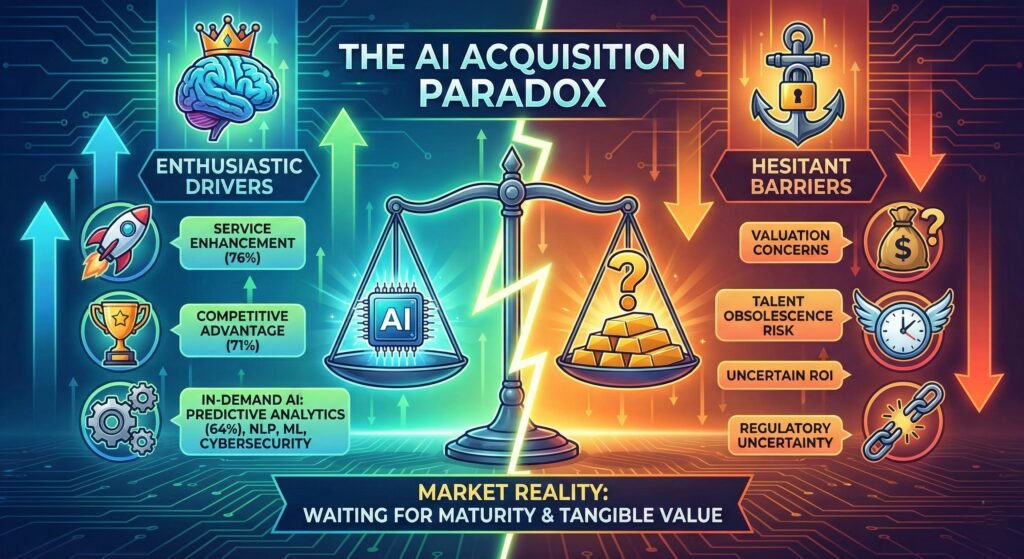

Over the years, the due diligence landscape has evolved, necessitating a more comprehensive approach due to ever-changing market dynamics. This shift allows firms to conduct deeper evaluations of potential acquisitions, focusing on understanding the target company’s culture, operational processes, and digital footprint. Statistics indicate that numerous acquisitions falter due to poor integration, often stemming from inadequate investigation. Hence, a systematic review process is essential for laying the groundwork for successful integration post-acquisition.

Experts assert that a successful business due diligence process is characterized by clarity in objectives and alignment with strategic rationale. Acquirers who exhibit a focused approach signal their understanding of the seller’s business, particularly advantageous in competitive auction scenarios. As highlighted by industry leaders, the roots of integration failure are often sown during the buying a business due diligence phase, underscoring the importance of a thorough and well-managed process.

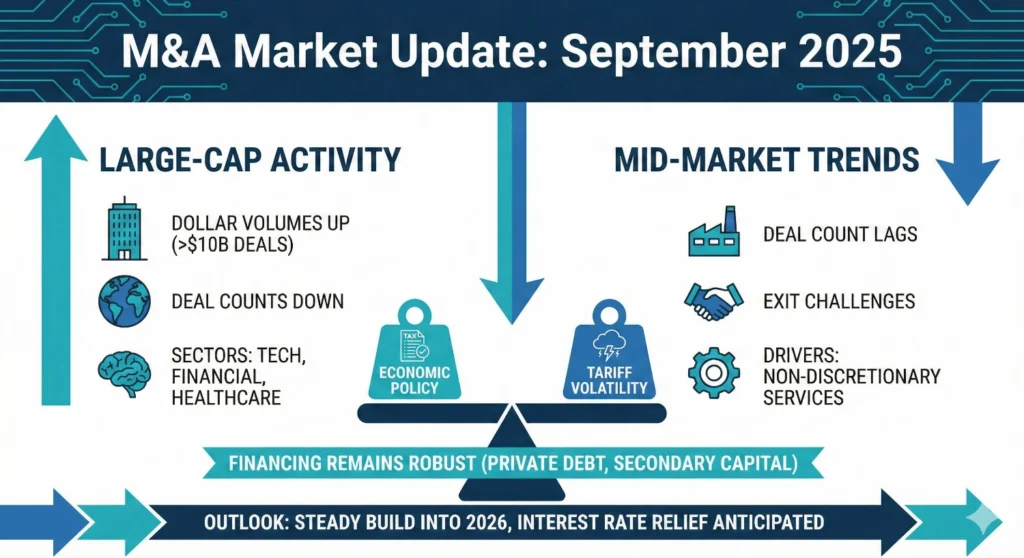

In 2025, the significance of careful consideration remains paramount, with a consistent focus on identifying risks and developing effective integration plans. The utilization of warranty and indemnity (W&I) insurance has also stabilized, reflecting a growing sophistication in managing transactional risks. As the M&A environment continues to evolve, the ability to conduct comprehensive assessments, will be a key factor in the success of acquisitions.

Follow a Step-by-Step Due Diligence Process

- Define Your Objectives: Initiate the due diligence process by articulating your goals with precision. Clearly identify your intended achievements and the specific information necessary about the target company for buying a business due diligence to align with your acquisition strategy. KSMC stands ready to assist in defining these objectives, ensuring they resonate with your profitability improvement and operational efficiency goals.

- Assemble Your Team: Construct a dedicated team of professionals, including financial analysts, legal advisors, and industry experts. Each member should have clearly defined roles, fostering a comprehensive approach to the due diligence process. KSMC enhances team effectiveness through expert consulting, leveraging functional experts with deep industry knowledge to significantly improve efficiency and effectiveness.

- Gather Information: Secure access to the target company’s financial statements, contracts, legal documents, and operational data. A comprehensive understanding of the business is crucial for buying a business, as protracted and unfocused investigations can disadvantage buyers in competitive markets. The consulting services of KSMC can streamline this process, assisting you in pinpointing essential data points that impact profitability and operational efficiency.

- Analyze the Data: Undertake a meticulous review of the collected information. Scrutinize for discrepancies, potential liabilities, and areas of concern that could affect the acquisition. Effective buying of a business not only identifies risks but also facilitates the development of integration plans, ensuring strategic alignment after the acquisition. KSMC offers valuable insights into utilizing this data to enhance profitability and operational efficiency.

- Conduct Interviews: Engage with key personnel within the target company to glean insights into its operations, culture, and any potential issues that may not be evident in the documentation. This step is essential for grasping the nuances of the business and fostering a positive relationship with the acquired management team. KSMC can assist in preparing these interviews to ensure that critical operational insights are captured.

- Prepare a Due Diligence Report: Compile your findings into a comprehensive report that outlines the strengths, weaknesses, risks, and opportunities associated with the acquisition. This report will serve as a vital tool in guiding your decision-making process, ensuring alignment with your strategic objectives throughout the transaction.

Identify Key Areas of Focus in Due Diligence

When conducting due diligence, it is essential to concentrate on the following key areas:

- Financial Well-being: Thoroughly review the target company’s financial statements from the past three to five years, including income statements, balance sheets, and cash flow statements. Pay close attention to trends in revenue, profitability, and debt levels, as these metrics are crucial for evaluating the company’s overall economic stability. Key economic health metrics to consider include gross profit margin, net profit margin, return on assets (ROA), current ratio, and working capital optimization. A strong economic health evaluation is essential for buying a business due diligence, as it can uncover potential risks and opportunities, guiding informed decision-making.

- Legal Compliance: Investigate any legal issues that may affect the acquisition, such as pending litigation, regulatory compliance, and intellectual property rights. Buying a business involves ensuring that the company is in good standing with all relevant authorities, as legal compliance issues can lead to significant liabilities post-acquisition. Transparency between the Seller and Buyer enable more seamless negotiations.

- Operational Efficiency: Assess the company’s operational processes, supply chain management, and employee performance. Recognizing inefficiencies or areas for enhancement is essential, and a due diligence can assist in identifying the necessary investments to align the target’s operations with Buyer’s strategic objectives. This evaluation should include operational readiness checks to ensure the business can run independently of the owner. Cost reduction strategies can enhance operational efficiency, supporting effective integration planning and maximizing value creation.

- Market Position: Analyze the company’s market share, competitive landscape, and growth potential. Understanding its customer base and any risks associated with market fluctuations is essential for evaluating the sustainability of the business model. A comprehensive market position analysis is essential for buying a business, as it can inform strategic decisions and highlight areas for future growth.

- Cultural Fit: Evaluate the company culture and management style to ensure alignment with your organization’s values and practices. Assessing human capital and leadership dynamics is crucial for identifying potential culture clashes. Addressing these aspects early on can facilitate smoother transitions and enhance team cohesion after the merger.

Utilize Tools and Resources for Effective Due Diligence

To conduct effective due diligence, consider utilizing the following tools and resources designed to enhance performance and achieve strategic financial objectives:

- Virtual Data Rooms (VDRs): Secure online platforms that facilitate the safe sharing and storage of sensitive documents during the evaluation process. VDRs improve cooperation among team members and simplify document management, which is crucial for the organization’s thorough economic analysis and quality of earnings evaluations.

- Due Diligence Checklists: Implement comprehensive checklists to ensure that all essential areas are addressed during the due diligence process. These checklists assist in maintaining order and focus, enabling teams to methodically assess the target company’s economic, legal, and operational elements.

- Technology and Automation: Leverage software/tools that automate analysis, enabling quick identification of trends and anomalies in the target company’s financial data. This technology enhances the thoroughness of financial assessments, ensuring that no critical insights are overlooked.

- Legal Research Tools: Legal research platforms that verify the target company’s compliance with regulations and uncover potential legal issues. These tools facilitate a deeper understanding of the legal landscape surrounding the acquisition, helping to mitigate risks associated with non-compliance.

- Industry Reports and Market Research: Access to industry reports and market research provides insights into the target company’s market position and competitive landscape. This information is crucial for informing strategic decisions during the acquisition process, ensuring that the buyer is well-equipped to navigate the complexities of the market while optimizing working capital and enhancing profitability.

Conclusion

The significance of a well-executed due diligence process cannot be overstated. It lays the groundwork for effective integration and long-term success post-acquisition. By emphasizing key areas of focus—such as financial well-being, legal compliance, operational efficiency, market position, and cultural fit—buyers gain a holistic view of the target company, facilitating informed decision-making. The utilization of tools like virtual data rooms and checklists further enhances the due diligence process, allowing for thorough evaluations and insights that drive successful acquisitions.

As the business landscape continues to evolve, embracing a meticulous approach to due diligence will empower buyers to navigate complexities and seize opportunities, ensuring that acquisitions contribute positively to their strategic goals.