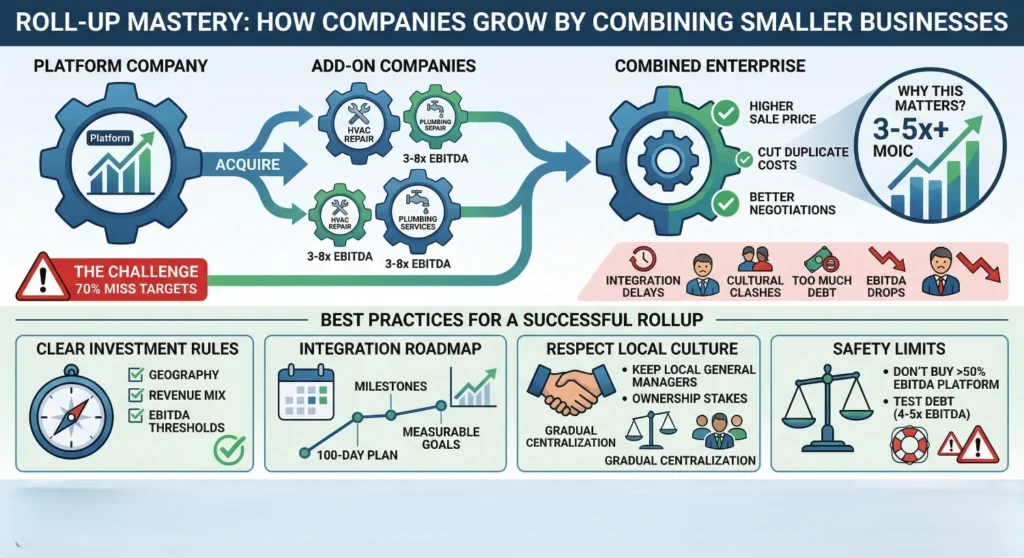

Roll-Up Mastery: How Companies Grow by Combining Smaller Businesses

A “roll-up” (also called “buy-and-build”) is when an investment firm buys one main company, then adds several smaller companies to it. They target fragmented industries (ones with many small players) like HVAC repair or plumbing services. The strategy works because: The Challenge: About 70% of these consolidations miss their targets. Common problems include: Why This Matters?: When done well, these strategies can deliver 3-5x+ MOIC (Multiple on Invested Capital—how many times you get back what you invested) through: Best Practices for a Successful Rollup: Real life Example: Morgan Stanley Capital Partners acquired Sila Services (a Pennsylvania-based residential HVAC company) in 2021. Over the subsequent 3.5 years, they built Sila into a platform operating over 30 brands across the Northeast, Mid-Atlantic, and Midwest regions through a combination of add-on acquisitions and operational improvements. In late 2024, they agreed to sell the company to Goldman Sachs Alternatives. While specific financial terms weren’t publicly disclosed, the transaction demonstrates how disciplined roll-ups can create significant value in fragmented service industries. Share Your Experience: Building a roll-up? We’d like to hear about your integration successes and challenges.